How to Write a Form 990 Late Filing Penalty Abatement Letter

Thursday, August 24, 2017

$12,000 Form 990 Daily Delinquency Penalty Abated by IRS for Reasonable Cause

Here's another CP141R Notice I received from the IRS for one of my penalty abatement engagements for a tax-exempt organization.

"Based on the information you provided, the penalty charge in the amount of $12,000 was removed."

"You don't need to do anything. If you've already paid the penalty and you don't owe other tax or debts we're required to collect, we'll send you a refund of the penalty amount you paid within six to eight weeks from the date of this notice."

Do you think my client was happy?

You bet!

IRS Abates $10,000 Late-filing Penalty for Nonprofit Organization

It's always a relief to receive an IRS CP210 Notice showing that a penalty waiver has adjusted the amount due to zero. This is a notice I received recently for a nonprofit client for which I have power of attorney. I wrote a reasonable cause abatement request on their behalf back in May 2017. So it took about two months for the IRS to process the correspondence and offer abatement of the $10,000 late-filing penalty for their Form 990.

A notice that is also sent out at roughly the same time as the CP210 is the CP141R, letting the organization know that the penalty charge has been removed from their account:

In this case, I wrote the letter myself. But in many cases, the abatement requests are written by nonprofit directors, CPAs, or attorneys who have purchase my Form 990 reasonable cause penalty abatement DIY materials and have written their own letter. All kinds of organizations have been successful in getting their penalties waived.

A notice that is also sent out at roughly the same time as the CP210 is the CP141R, letting the organization know that the penalty charge has been removed from their account:

In this case, I wrote the letter myself. But in many cases, the abatement requests are written by nonprofit directors, CPAs, or attorneys who have purchase my Form 990 reasonable cause penalty abatement DIY materials and have written their own letter. All kinds of organizations have been successful in getting their penalties waived.

Friday, December 9, 2016

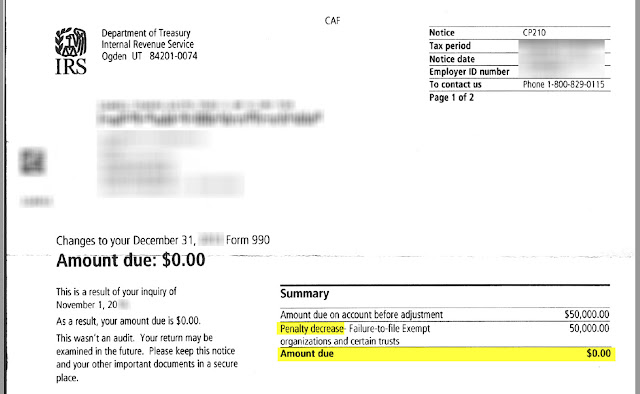

$50,000 Form 990 Late-Filing Penalty Abated for Nonprofit

If you were the executive director of a nonprofit organization and got a notice from the IRS saying your organization owed a $50,000 penalty, how would you feel?

That kind of penalty could bankrupt a lot of organizations.

Or what if you are a CPA and you contributed to the late-filing of the return. Perhaps you forgot to file an extension request.

Relief is available under section 6652 of the Internal Revenue Code.

Contact me and let me help you like I helped the organization that received the notice above. I wrote their penalty abatement request letter and got the penalty abated.

That kind of penalty could bankrupt a lot of organizations.

Or what if you are a CPA and you contributed to the late-filing of the return. Perhaps you forgot to file an extension request.

Relief is available under section 6652 of the Internal Revenue Code.

Contact me and let me help you like I helped the organization that received the notice above. I wrote their penalty abatement request letter and got the penalty abated.

Monday, August 24, 2015

IRS Notice CP210: How the IRS Notifies You that Your Penalty Has Been Abated

Notice CP141R tell you that the IRS has "Removed your penalty charge" and that you don't need to do anything.

Notice CP210 (pictured above) shows how much the penalty was and how much the decrease in the penalty was. Generally the IRS only has the authority to completely remove a late-filing penalty for Form 990. It does not technically have the authority to reduce the penalty, unless you can show that it was calculated incorrectly.

If your nonprofit organization is facing an IRS penalty, contact me. I can help.

Monday, December 8, 2014

What if I Can't File IRS Form 990 by the Extended Due Date?

If you have already requested two extensions of time to file your Form 990 and still don't have enough information to file a perfect return, consider using estimates for the missing information. File the return with estimated figures and disclose the estimates on Schedule O.

Then when you get the actual amounts, prepare and file an amended return. This isn't a perfect solution, and you have to use good judgement. You can't fabricate an entire return, but don't let a few pieces of missing information push you into a penalty situation.

Thursday, November 27, 2014

Why IRS Form 990 is One of the Most Important Documents for Nonprofits

Why Form 990 is One of the Most Important Documents Your Nonprofit Produces

To most nonprofit officers, directors, and managers, Form 990 is an annoyance. It's just another government hoop to jump through on the way to accomplishing your all-important mission.For those of you who rely on certain types of grants, you probably see Form 990 as your ticket to getting the grant, since some grant-making organizations demand a copy of the most recent Form 990.

I've looked at enough Form 990's and helped with enough penalty abatement cases to know that most organizations, and even most CPAs don't take Form 990 seriously.

That's a big mistake and a lost opportunity.

It's a big mistake because even a small mistake on Form 990 can result in big penalties. Did you know that filing an "incorrect or incomplete return" is the same as not filing a return at all? Forget to check a box properly or forget to file a required schedule can trigger massive penalties.

Watch the video above for some information that might surprise you.

Thursday, January 10, 2013

Follow Up With IRS Exempt Organization Division After Writing to Request Penalty Abatement

In late 2012 and early 2013 the IRS Exempt Organization Division has been very slow sometimes in responding to penalty abatement request letters. This can lead to major problems. In this video I offer some advice on how to deal with this. It has been effective for me and for several of my clients.

Subscribe to:

Comments (Atom)