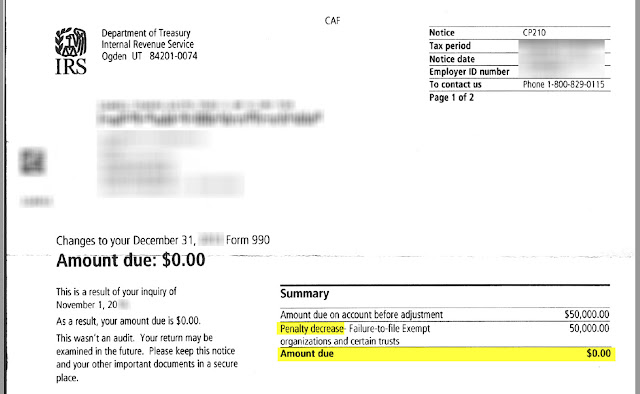

If you were the executive director of a nonprofit organization and got a notice from the IRS saying your organization owed a $50,000 penalty, how would you feel?

That kind of penalty could bankrupt a lot of organizations.

Or what if you are a CPA and you contributed to the late-filing of the return. Perhaps you forgot to file an extension request.

Relief is available under section 6652 of the Internal Revenue Code.

Contact me and let me help you like I helped the organization that received the notice above. I wrote their penalty abatement request letter and got the penalty abated.